USAA RV insurance becomes a crucial consideration for RV owners, acknowledging the significance of comprehensive coverage for frequent travelers or full-time RV residents.

This insurance shields against potential financial losses stemming from accidents, theft, vandalism, fire, or other damages incurred by the RV.

Moreover, it extends liability coverage to safeguard against injuries or property damage caused while operating or parking the RV.

USAA RV insurance eligibility

USAA RV insurance is only available to eligible members of USAA, which means you have to be either:

- An active, retired, or separated military member with a discharge type of “Honorable”

- A spouse or child of a USAA member or a deceased USAA member who had USAA property or auto insurance

- A cadet or midshipman at a U.S. service academy, in advanced ROTC, on ROTC scholarship, or an officer candidate within 24 months of commissioning

If you meet these criteria, you can apply for USAA RV insurance online, by phone, or through the USAA mobile app.

You will need to provide some personal and vehicle information, such as your name, address, date of birth, driver’s license number, RV make, model, year, and VIN.

USAA RV insurance cost

The cost of USAA RV insurance depends on several factors, such as:

- The type, size, and value of your RV

- The amount and type of coverage you choose

- Your driving history and credit score

- Your location and how often you use your RV

- The deductible you select

According to USAA, the average annual premium for RV insurance is $376, but this may vary depending on your specific situation. To get a more accurate estimate, you can request a quote from USAA online, by phone, or through the app.

Benefits of choosing USAA

USAA RV insurance offers several benefits that make it a great choice for RV owners, such as:

Competitive rates: USAA RV insurance ensures affordability with competitive premiums and deductibles.

Take advantage of discounts for bundling with other USAA products, maintaining a clean driving record, completing a defensive driving course, or installing safety devices on your RV.

Flexible coverage: Tailor your coverage to your preferences with a variety of options. Adjust your limits and deductibles at any time, and choose to suspend coverage during unused periods, such as winter, saving on premiums.

Excellent service: Benefit from 24/7 customer service and claims support, with convenient online and mobile access to policy details. Rely on USAA’s network of trusted repair shops or choose your own. The company is committed to providing top-notch service.

Reputation and trust: Backed by USAA’s legacy since 1922, USAA RV insurance embodies excellence, integrity, and loyalty. With an A++ rating from A.M. Best, an A+ rating from the Better Business Bureau, and a 97% customer satisfaction rating from Consumer Reports, USAA stands as a trusted choice for RV insurance.

USAA RV Insurance claims process

Claim process: File a claim online or on the USAA mobile app, even without all details. You can add more later. Provide the following information:

- Date of the accident

- Basic details of what happened

- Names of all drivers and passengers

- Insurance information for any other drivers

- Upload photos of the property or vehicle damage

- Upload documents

- Review your coverage

Claim status: Check the status of your claim online or on the USAA mobile app. On usaa.com, find your active claim next to your policies. Select the claim, go to the “Your Claims” page, and choose “Check Claim Status.”

On the USAA mobile app, tap on “Claims” to go to “My Claims Center,” and go to your active claim, tap on “Check claim status.”

Required documents for claims: Submit documents depending on the type and extent of the damage. Some common documents include:

- Police/Accident/Incident report(s)

- Copy of repair estimate/invoice

- Pictures of vehicle damage, including accident scene photos

- Proof of any payments made to the rental car company for damage

Average claim approval time: Approval time depends on the complexity of the claim and adjuster availability. Simple claims may take an hour, while more complex ones may take weeks. USAA may take up to 7 business days to receive and review the estimate.

Getting a quote

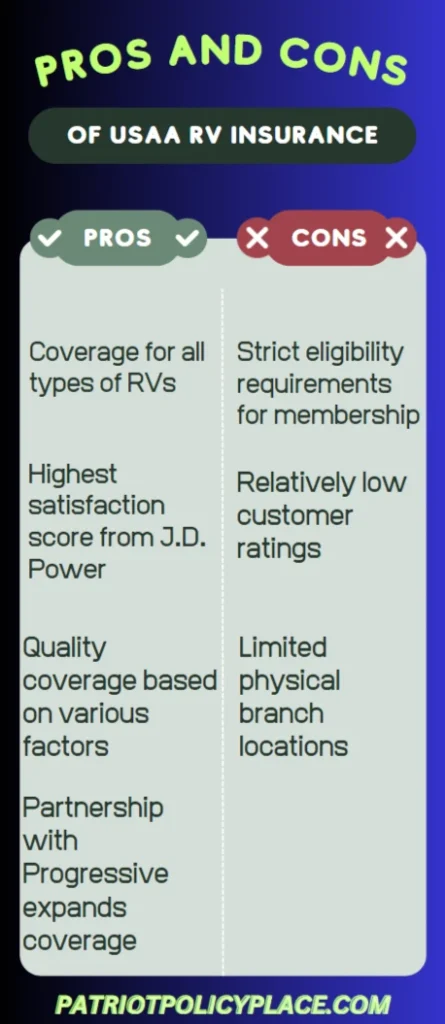

Pros and cons of USAA RV Insurance

Discover the benefits of choosing USAA for your RV insurance needs. Unlock savings through various discounts and enjoy coverage for all types of RVs.

With the highest satisfaction score from J.D. Power for 23 consecutive years, USAA ensures quality coverage based on price, claims, interaction, policy offerings, billing process, and policy information.

USAA’s alliance with Progressive enables coverage for travel trailers, motorhomes, pop-up campers, slide-on campers, fifth-wheel trailers, and class A, B, and C motorhomes.

Manage your insurance seamlessly through the user-friendly USAA mobile app, offering features like reporting claims, requesting roadside assistance, and conducting banking transactions.

However, be aware of USAA’s strict eligibility requirements, limiting membership to those with military affiliations.

Additionally, customer ratings are relatively low, and physical branch locations are limited. Despite these drawbacks, USAA stands out as a reliable choice for RV insurance.

Check for eligibility and explore your potential savings by obtaining a quote on the USAA website or through direct communication with a representative.

Find more of USAA Insurance company by following this link